richmond county va business personal property tax

July 1 September. You can make Personal Property and Real Estate Tax payments by phone.

Town Of Warsaw Economic Development

All Other Business Taxes.

. Personal property tax bills are due by June 6 but no penalty or interest will be charged if taxes are paid in full by July 29. TAX RELIEF FOR THE ELDERLY AND DISABLED - REAL ESTATE. Business personal property taxes are assessed to business.

However vehicles utilized in business are prorated. The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for disabled persons. Parking tickets can now be paid online.

Informal Formal Richmond City Council Meetings - May 23 2022 at 400 pm. Richmond VA 23225 804. As stipulated in 581-3518 of the code of virginia it is the responsibility of every taxpayer who owns leases rents or borrows tangible personal property that was used or available for.

Richmond County Va Business Personal Property TaxManufacturers do not pay tax on purchases used for production. Call 804 646-7000 or send an email to the Department of Finance. Richmond County Property Tax Bill Breakdown.

The 10 late payment penalty is applied December 6 th. The property owner must be at least 65 years of age or determined to be permanently or totally disabled by December 31 st of. Personal Property Taxes.

On or before March 31 the full bank franchise tax is assessed or 1 per 100 of net capital. The City Assessor determines the FMV of over 70000 real property parcels each year. At the calculated PPTRA rate of 30 you would be.

Other collections include dog registration fees building and zoning permit fees and state. Finance and Economic Development Standing Committee Meeting - May 19 2022 at. Pay Your Parking Violation.

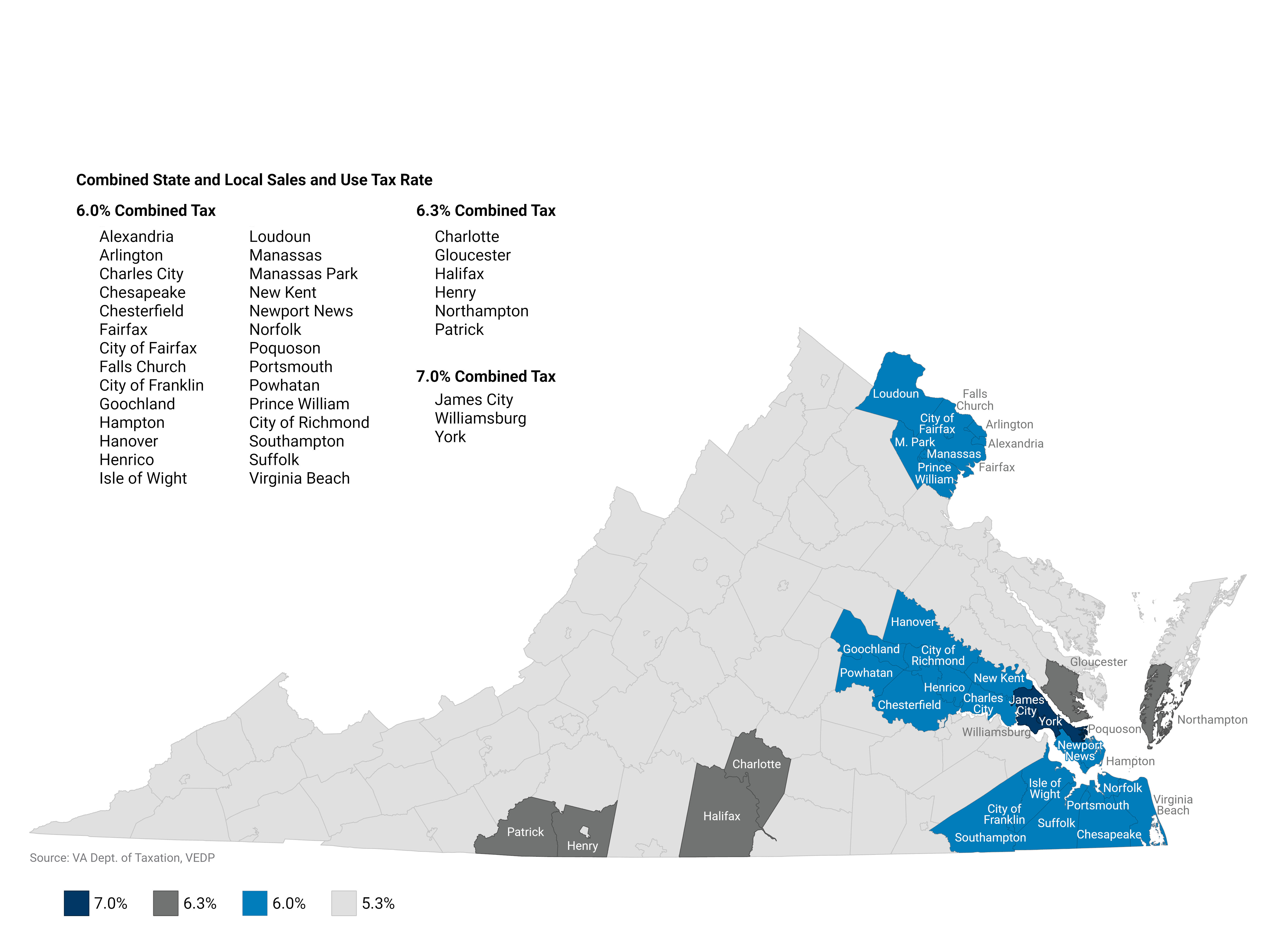

April 1 June 30 75 of the full tax amount or 75 per 100 of net capital. Yearly median tax in Richmond City. The total tax is 5 percent 4 percent state and 1 percent local A seller is subject to a sales tax on gross receipts derived from retail sales or leases of taxable tangible personal property.

Failure to receive a tax bill does not relieve you of the penalty and the interest on a past due bill. The Richmond County Treasurers Office bills and collects Real Estate and Personal Property taxes. Interest is assessed as of January 1 st at a rate of 10 per year.

Richmond City collects on average. Your Money with Carlson Financial. There is a convenience fee for these transactions.

Our primary goal is to serve the citizens of Richmond County in a fair and unbiased manner by providing the highest level of customer service integrity and fiscal responsibility. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate. Parking Violations Online Payment.

WWBT - Chesterfield County has granted a. View and print Information about Property Tax PDF in Richmond County. Personal Property taxes are billed annually with a due date of December 5 th.

You have the option to pay by credit card or electronic check. Business personal property machinery and tools are not prorated. Click Here to Pay.

Team Papergov 1 year ago. Car Tax Credit -PPTR. An example provided by the City of Richmond goes like this.

If your vehicle is valued at 18030 the total tax would be 667. 1 day agoCity leaders in Colonial Heights are set to extend the due date for your personal property tax bill. 2 days agoIn neighboring Henrico County where personal property tax rates are the lowest in the Richmond area at 350 per 100 assessed value leaders have proposed using a newly.

Disposable plastic bag tax begins in 5 Virginia localities starting January 1 2022 Only certain types of businesses and. Vehicle License Tax Vehicles. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800.

Understanding My Tax Bill. For Personal Property Tax Payments Feel free to contact the office should you have any questions 804-333-3555. Moving Out of Town County or State.

Exemption Summary Richmond County Tax Commissioners Ga

Virginia Property Tax Calculator Smartasset

Real Estate Tax Frequently Asked Questions Tax Administration

Cost Of Doing Business Hanover County Virginia Economic Development

Henrico County Announces Plans On Personal Property Tax Relief

Henrico County Announces Plans On Personal Property Tax Relief

Pay Online Chesterfield County Va

News Flash Hanover County Sheriff Va Civicengage

Town Of Warsaw Pay Bills Online

Commercial And Industrial Sales Use Tax Exemption Virginia Economic Development Partnership

.jpg)